Most basketball trainers fantasize about opening their own facility. But when it comes to actual numbers, the information gets vague fast.

“A lot of people just want the convenience and be able to say that they own a gym just so they can say that they do,” says Tyler Leclerc, owner of two successful Massachusetts training facilities. “When in reality, it doesn’t actually make economic sense.”

Tyler opened his first facility in 2020 after two years of grinding and saving. Here’s the complete financial breakdown — the real numbers trainers need before signing a lease.

The $50,000 Startup Reality

Tyler’s First Facility (Lowell, MA – 3,500 sq ft total, 2,500 sq ft court):

Initial Capital Required: $50,000

Lease Deposits & Fees: ~$12,000

- First month’s rent: $3,100

- Last month’s rent: $3,100

- Security deposit: $3,100

- Broker fees/misc: $2,500-3,000

Court Installation: $25,000 (Largest single expense)

- Sport court flooring

- Line painting (NBA, high school, free throw)

- Installation labor

- Subflooring prep (if needed)

Basketball Equipment: $8,000-10,000

- Hoops and mounting systems (2-4 hoops)

- Basketballs (various sizes)

- Agility equipment (cones, ladders, resistance bands)

- Storage racks and organization

- Training aids (shooting machines optional but add $5K-15K)

Miscellaneous: $5,000-8,000

- Insurance (liability, property): $2,000-3,000/year upfront

- Utilities setup and deposits: $500-1,000

- Signage and branding: $1,000-2,000

- Lighting upgrades: $1,000-2,000

- Sound system: $500-1,000

- Waiting area furniture: $500-1,000

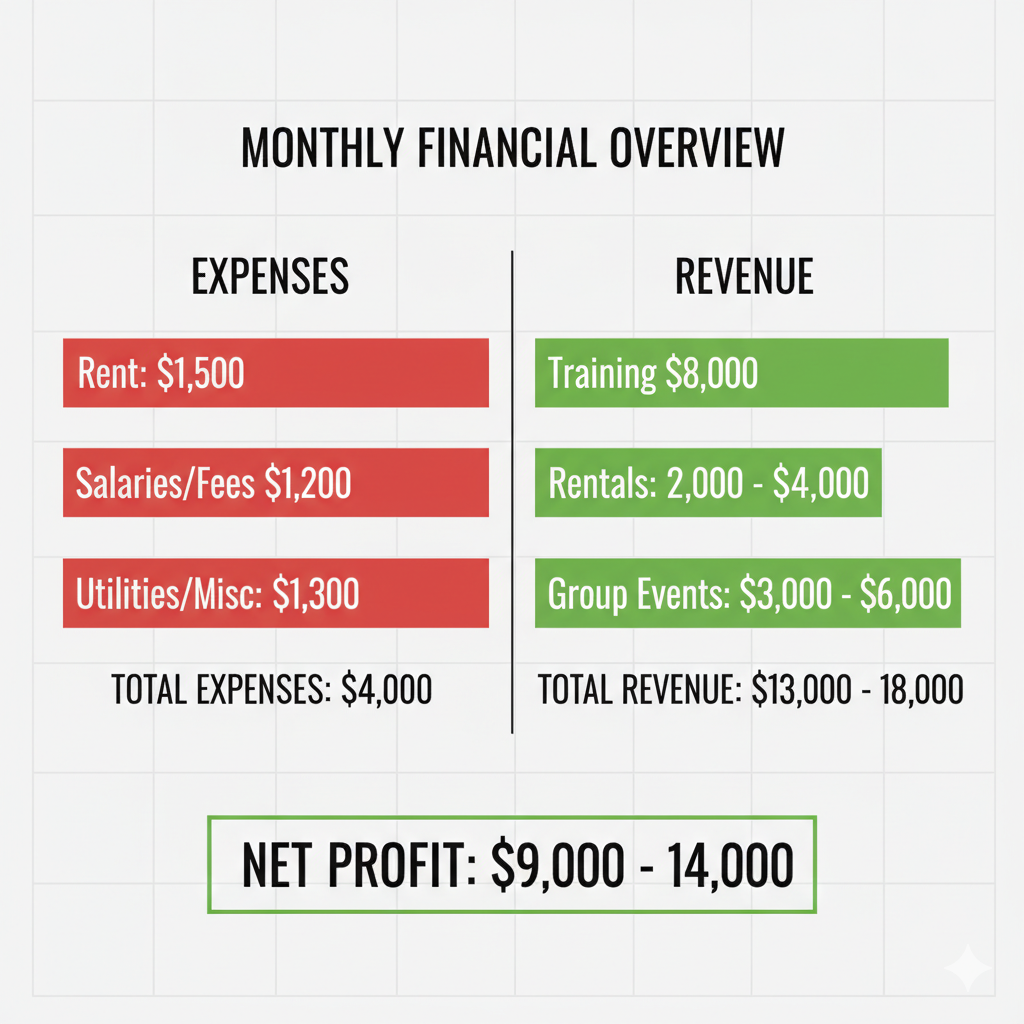

Monthly Operating Expenses: $4,000

Fixed Costs:

- Lease: $3,100/month

- Insurance: $200-250/month

- Utilities (electric, heat, water): $300-500/month

- Internet/phone: $100-150/month

- Software/systems: $100-200/month

- Miscellaneous/maintenance: $150-300/month

“I knew worst case, even if I don’t rent the gym at all, I’m making $8,000 a month from training and my expenses are $4,000,” Tyler explains. “So I’m at $4,000 profit, but also counting in the opportunity costs.”

The Break-Even Calculation

Here’s the critical math trainers miss:

Option A: Keep Renting Courts

- Training 30hours/week

- Court rental: $50-60/hour

- Monthly cost: $6,000-7,200 in rental fees

- Zero equity, zero control, limited hours

Option B: Open Your Own Facility

- Same 30 hours/week training

- Monthly expenses: $4,000

- Own equity, full control, unlimited access

- Can rent court when not using (+$2,000-4,000/month potential)

“At that point, I was paying just as much in court rental fees as I would have in my own gym,” Tyler says. “So it just made sense.”

Tyler’s break-even logic:

- Monthly revenue from training: $8,000

- Monthly facility expenses: -$4,000

- Net profit: $4,000/month

- Court rental revenue: +$2,000-3,000 (covers lease entirely)

- Effective profit: $6,000-7,000/month

Payback Period

With $50,000 startup and $4,000/month profit from training alone:

- 12.5 months to recoup initial investment

- After month 13: Pure profit (minus ongoing expenses)

Add court rental income and the payback accelerates to 8-10 months.

The Hidden Costs Nobody Tells You

Year 1 Unexpected Expenses:

- HVAC repairs/maintenance: $500-2,000

- Flooring repairs (high-traffic wear): $500-1,500

- Equipment replacement (nets, rims): $300-800

- Marketing/advertising (if not DIY): $1,000-3,000

- Legal/accounting: $1,000-2,000

Plan for an additional $5,000-10,000 buffer in Year 1.

The Revenue Model That Works

Tyler’s facility doesn’t just break even — it thrives. Here’s how:

Revenue Streams

1. Personal Training

- 25-30 hours/week at $80-120/hour

- Monthly: $8,000-14,000

2. Court Rentals

- Weekday evenings: $60-80/hour

- Weekend blocks: $100-150/hour

- 15-20 rental hours/week average

- Monthly: $2,400-4,800

3. Group Training/Camps

- Group sessions: $30-50 per athlete

- 8-12 athletes per group

- Seasonal camps and clinics

- Monthly: $3,000-6,000

Total Monthly Revenue Potential: $13,400-24,800

“I essentially get a free gym every single month,” Tyler explains. “The court rentals when I’m not working pay for that gym lease and all the expenses. I get to train for free while other trainers are paying $50-60 an hour.”

When You’re Actually Ready to Open

Tyler’s prerequisites before signing a lease:

Financial Requirements:

✅ $50,000+ liquid capital (don’t drain your emergency fund)

✅ $8,000-10,000/month in training revenue (6+ months consistent)

✅ 30+ hours/week of training clients (proven demand)

✅ 3-6 months operating expenses saved (safety net)

Business Requirements:

✅ Established reputation in your market

✅ Waitlist or turned-away clients (built-up demand)

✅ Systems in place (scheduling, payments, communication)

✅ Clear growth plan (how you’ll fill additional hours)

“You need to build up a legitimate business, a legitimate clientele to even be in the position to go and get that gym,” Tyler emphasizes.

The Landlord Conversation

What landlords want to see:

- Proof of income: 6-12 months of bank statements showing consistent training revenue

- Business plan: How you’ll afford rent, growth projections

- Credit score: Personal credit matters for first-time facility owners

- References: From previous landlords or business partners

- Deposit: Often 3x monthly rent (first, last, security)

“They’re going to laugh at you because you made $500 last month,” Tyler warns. “Like you need to build up a legitimate business first.”

Location Strategy

Tyler’s facility is “in a little industrial area, not the prettiest, sexiest place.”

Why that works:

Industrial/Commercial Advantages:

- Lower rent ($3,100 vs $6,000+ in retail spaces)

- Higher ceilings (12-15 feet needed)

- Loading dock access (equipment delivery)

- Fewer noise complaints

- Ample parking

Location Checklist: ✅ Within 1 mile of highway (Tyler: “right off the highway”)

✅ 15-20 minute drive from target market

✅ Safe area with good lighting/parking

✅ Zoning allows recreational/athletic use

✅ Adequate electrical capacity (court lighting draws heavy power)

“It’s not where you would necessarily expect it, which I kind of like,” Tyler says. “It’s just kind of a development factory — a tucked away place.”

The Opportunity Costs That Multiplied His Business

Tyler didn’t just look at rent vs. revenue. He calculated intangible benefits:

Hidden ROI:

- Content creation: Unlimited access to record training videos (social media growth)

- Professional credibility: “I have my own gym” attracts higher-paying clients

- Networking: Other trainers want to rent, creating partnerships

- Flexibility: Train early mornings, late nights without gym politics

Real example: Opening his facility led to a DM from Coleman (By Any Means Basketball), which turned into Master of Hoops partnership — a separate business that compounds his brand and revenue.

“Like whole bunch of opportunities opened up because of that opportunity,” Tyler reflects.

The Systems That Make It Profitable

Tyler’s facility isn’t just a space — it’s a systematized business.

Essential systems before opening:

- Automated scheduling — Parents book online, see real-time availability

- Payment processing — Recurring memberships, no more Venmo chasing

- Client management — Track progress, packages, communication

- Court rental booking — Self-service system for external rentals

“Sometimes trainers are like, ‘I don’t want to pay for the software,'” Tyler says. “Dude, you’re thinking very, very small. The amount of mental energy and time you gain back helps you tenfold.”

Without systems, you’re trading gym rent for admin chaos.

Bottom Line: Is It Worth It?

Tyler’s verdict: “If you’re a trainer and you can get to that point [30+ hours/week, consistent revenue], it’s 100% a competitive advantage.”

But not for everyone.

❌ Don’t open if you’re:

- Training fewer than 20 hours/week

- Making less than $6,000/month consistently

- Haven’t saved $50,000+ startup capital

- Hoping a gym will magically attract clients

✅ Do open if you’re:

- Paying $3,000+/month in court rentals

- Turning away clients due to gym availability

- Ready to commit 3-5 years to the space

- Have systems to manage the business side

“For a lot of people, it’s not the best business to run,” Tyler admits. “But if you’re a trainer, I think it’s one of the smartest things you could do.”

Your Next Steps

If you’re 1-2 years away from opening:

- Focus on client volume (train 100+ sessions/month)

- Save aggressively ($1,000-2,000/month minimum)

- Build systems now (scheduling, payments)

- Document your current court rental costs

What to do if you’re 6-12 months away:

- Start scouting locations (industrial areas, 2,500-3,500 sq ft)

- Get pre-approved for business loan if needed

- Build relationship with commercial real estate agents

- Create detailed business plan with projections

Ready Now?:

- Get quotes from 3+ court installation companies

- Review lease terms with a lawyer (don’t sign blindly)

- Set up business entity (LLC recommended)

- Book a CoachIQ demo to systemize before day one

Read more from Tyler’s journey: From Grinding 7 Days a Week to Two Facilities: Tyler Leclerc’s Blueprint

Learn from Tyler directly:

- Website: tjltraining.com

- Instagram: @TJLTraining

- Full podcast: CoachIQ Podcast Ep 02